Are you tired of the hassle of dealing with your Port Harcourt (PHED) electricity bills? Look nowhere else ! You can now simply, safely, and swiftly pay your PHEDC electric bills from the comfort of your home using the VTpass app. In this blog post, we’ll walk you through the easy procedures of utilizing the VTpass app to conveniently pay your PHEDC

Follow these steps to Pay your PHED Electric bill on the VTpass App

First, get the VTpass app.

Download the VTpass app from the App Store or Google Play Store directly on your mobile device. It’s free and easy to install, so you can start using it right away.

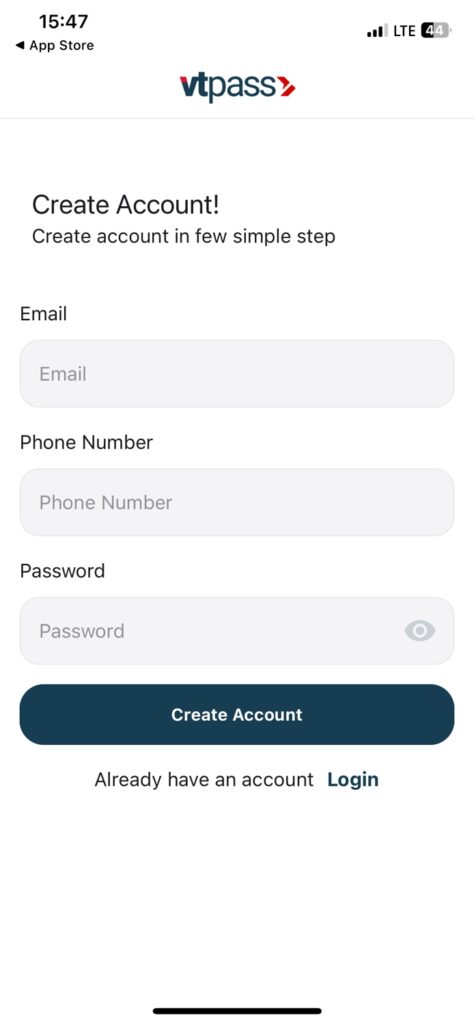

Create your VTpass account in Step Two.

Create a VTpass account after downloading the app. Setting it up is simple—just enter your phone number, email address, and password. This account will allow you to pay your electricity bills and more.

Step 3: Choose “Pay My Port Harcourt Electricity Bill”

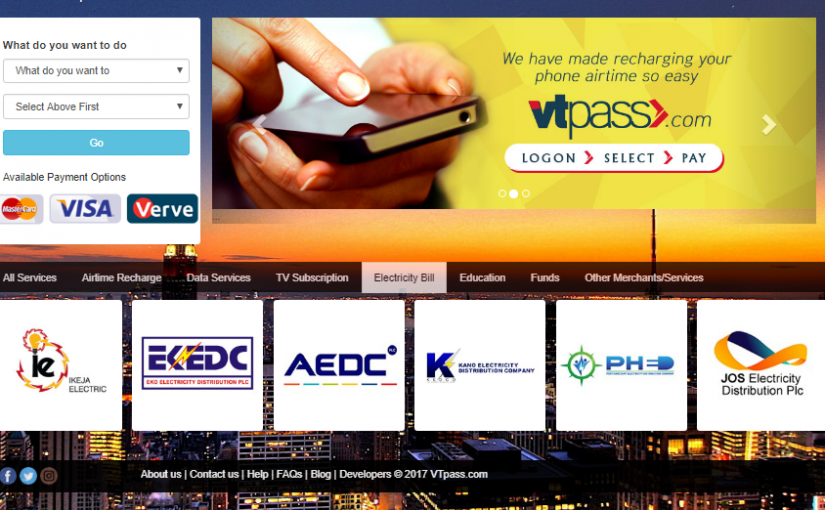

Once your VTpass account is ready, head to the “Electricity” section within the app. From there, choose “Port Harcourt Electricity” from the available options.

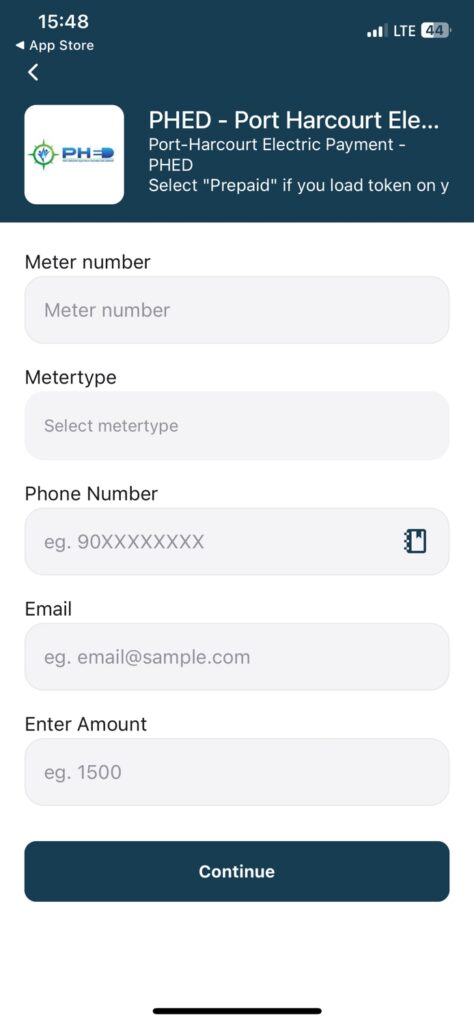

Step 4: Provide your details and meter number.

Provide your meter number and other necessary details, including your name and contact information. Double-check everything for accuracy to avoid any payment issues.

Step 5: Select Your Mode of Payment

VTpass provides a variety of payment methods to suit your needs. Debit cards, credit cards, and other alternative payment methods, which also include bank transfers and USSD codes, can all be used to make payments.

Step 6: Finish Making Your Purchase

Follow the instructions carefully to securely complete the transaction once you’ve chosen your payment method. You’ll receive a confirmation notification as soon as the payment is successfully processed.

Step 7: Get a confirmation of your payment

Upon successful payment, you will receive a confirmation.You can also view your payment history and download receipts directly from the VTpass app for your records.