Are you mentally exhausted and don’t know it? There always exist periods where it seems you lose interest in working and develop what can be described as an apathy towards work. Someone could even say you’re being lazy or laidback towards work.

We’ll walk you through a quick test today to check if you’re dealing with exhaustion or you’re just really lazy.

1. You Don’t Feel Motivated.

Firstly, you don’t feel motivated. Not feeling motivated is not always a sign of laziness, it can actually be a pointer to emotional exhaustion sometimes which arises as a result of the fact that you have done so much brainwork without adequate rest.

2. You Can’t Focus Or Concentrate.

Secondly, you are losing focus. Are you finding it hard to concentrate on what needs to be done? If you find yourself getting distracted easily, it could be a pointer to the fact that you are stressed and it needs to be managed before it affects you at the workplace.

3. You Constantly Fantasize About Drastic Change

Thirdly, you’re in a fantasy world. Do you find yourself suddenly imagining what your life would look like if you won the lottery? Or if someone suddenly relocated you away from the country? Using such fantasies to escape your present reality is a pointer to emotional exhaustion.

4. Small Tasks Seem Overwhelming.

Similarly, when stressed or mentally exhausted, you suddenly begin to struggle with tasks that you naturally would execute. At this point, work seems like a big deal and you just need it all to stop so you can breathe.

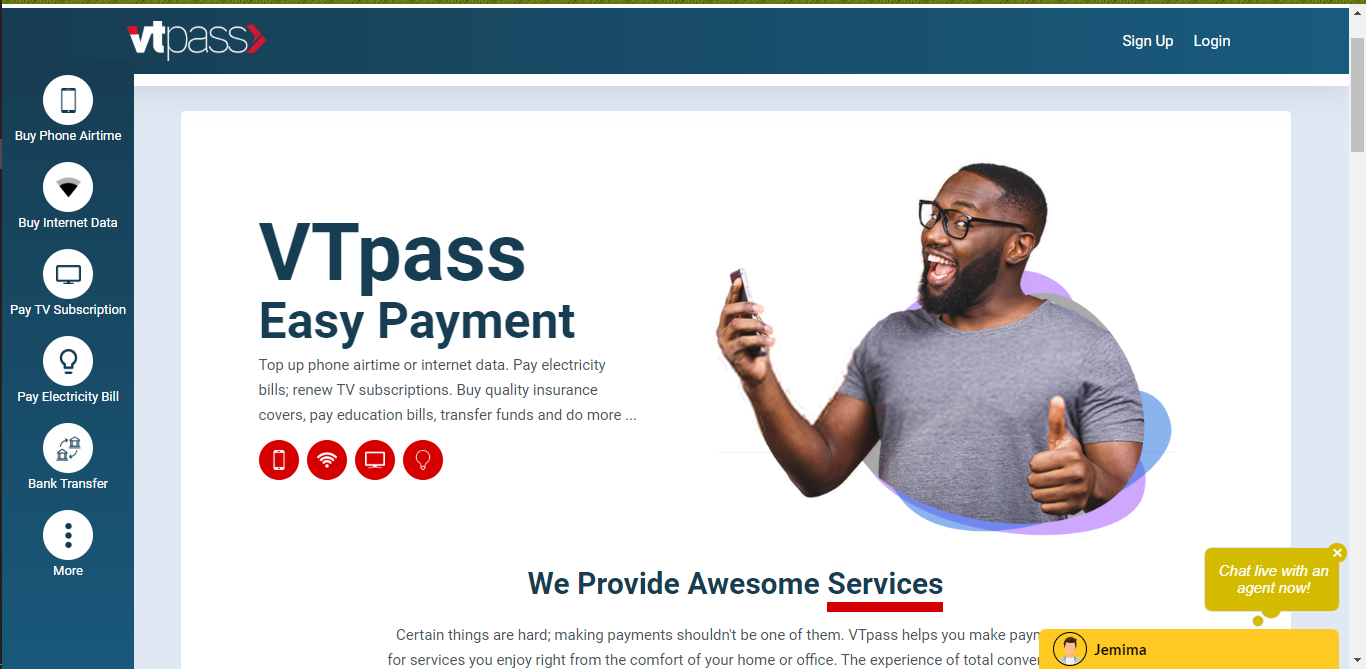

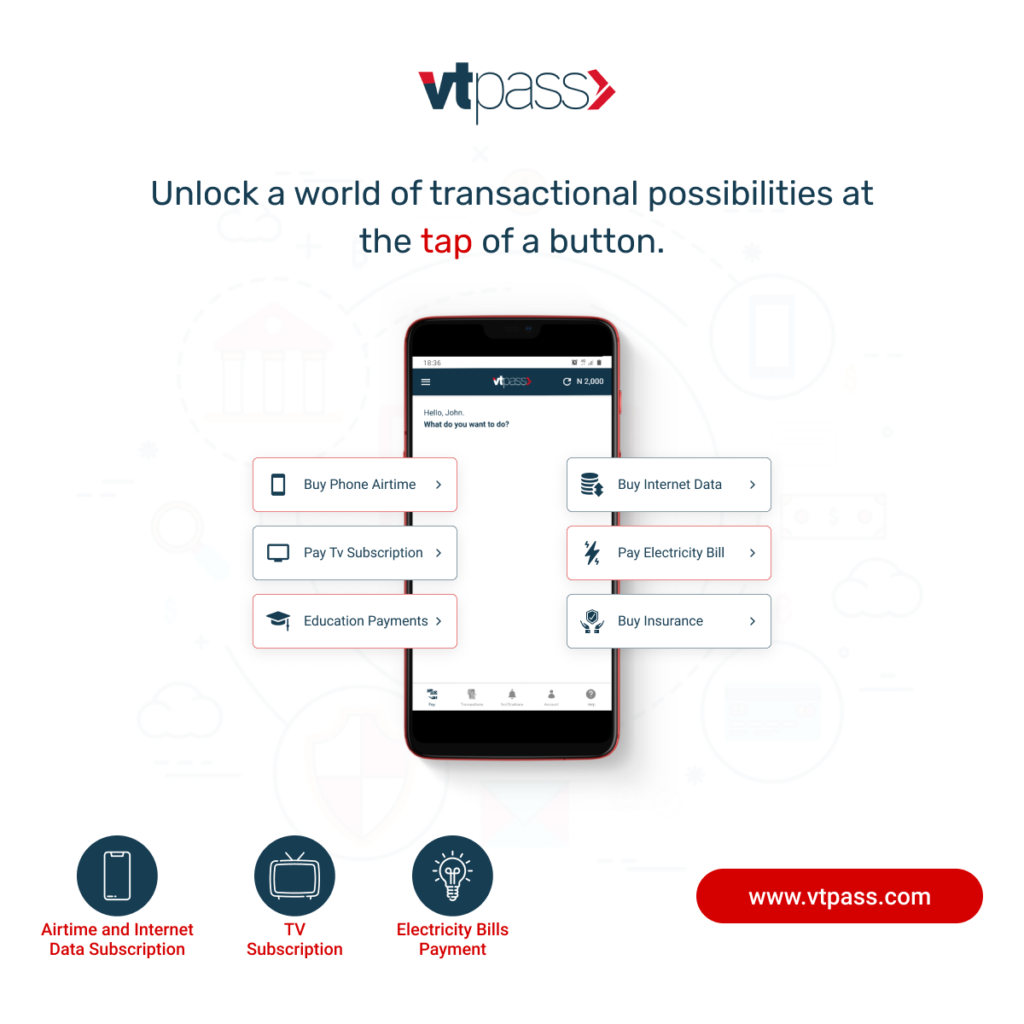

5. Making Your Bill Payments Stresses You.

In conclusion, we know any little thing stresses you out when you’re exhausted, especially when it concerns money. That’s why with vtpass.com, you can buy airtime/data, subscribe GOtv, DStv, or Startimes, pay electricity bills, buy insurance or pay educational bills at the tap of a button. Above all, you eradicate stress!