E-payments in Nigeria saw a total transformation during the lockdown. Yes, the pains of COVID-19 were felt but perhaps it left us with a few lessons too. We witnessed the difficulties associated with economic stagnation and knew the importance of business activities in any economy.

From the angle of finance, the pandemic gave insights into the future of payments in Nigeria. A study by Accenture revealed the limitation of cash and the increase of digital payment during the lockdown periods worldwide. For Nigeria, this is especially true.

Even though people withdrew more cash than ever from ATMs around the country, less than 60% of that cash was actually spent. This was due to cash hoardings by people amidst not knowing when the lockdown would be eased.

Lack of physical cash gave boosts to online payments. Cashless and contactless payments became the norm so as to reduce the risk of contracting the virus.

The long queues at ATMs were yet another factor. It was far easier to make payments digitally than paying in cash. Many individuals and businesses that could operate during the lockdown switched to electronic payment. All of these exploded e-payments around the country.

Just how much explosion? you might ask. In May 2020, e-payments in Nigeria jumped by 82% to ₦11.676 trillion from ₦6.421 trillion in April 2020. An all-time high!

Online retailers and payment platforms saw increases in patronage too, even as other consumer spendings decreased. This was evidenced by the increase in the number of online stores and internet marketers during the lockdown.

Now, as the country kick-starts full operations of economic activities, the question remains; would the rate of e-payments in Nigeria reduce, or would it increase in the coming months?

Why e-Payment would increase

Electronic bill payments for goods and services around the country are only bound to increase. Here are two major post-COVID reasons why this would happen:

- Personal Precautions:

The crisis may be relaxed but the ‘panic’ still exists for many. Millions of people would still prefer to take the safer route when making bills payments – that is to pay online.

Many health experts have warned about the risk of contacting COVID-19 from unaware, new carriers not detected during the quarantine. As such, the need to protect personal self from contacting the virus through cash handling or contact payment would keep a lot of people on the online payment track for a very long time.

- Convenience:

For many, the quarantine was their chance to experience online payment for the first time. Convinence has been the major driver of e-payments since inception; it’s no wonder why a large percentage of new users would want to stick with the system.

World Bank already predicted that 25% of all money transfers would be done electronically by 2025; a chunk of that increase coming from new e-payment users in Africa. Convinence and speed of payment are major drivers that would prompt these new users to switch paymently to e-transactions.

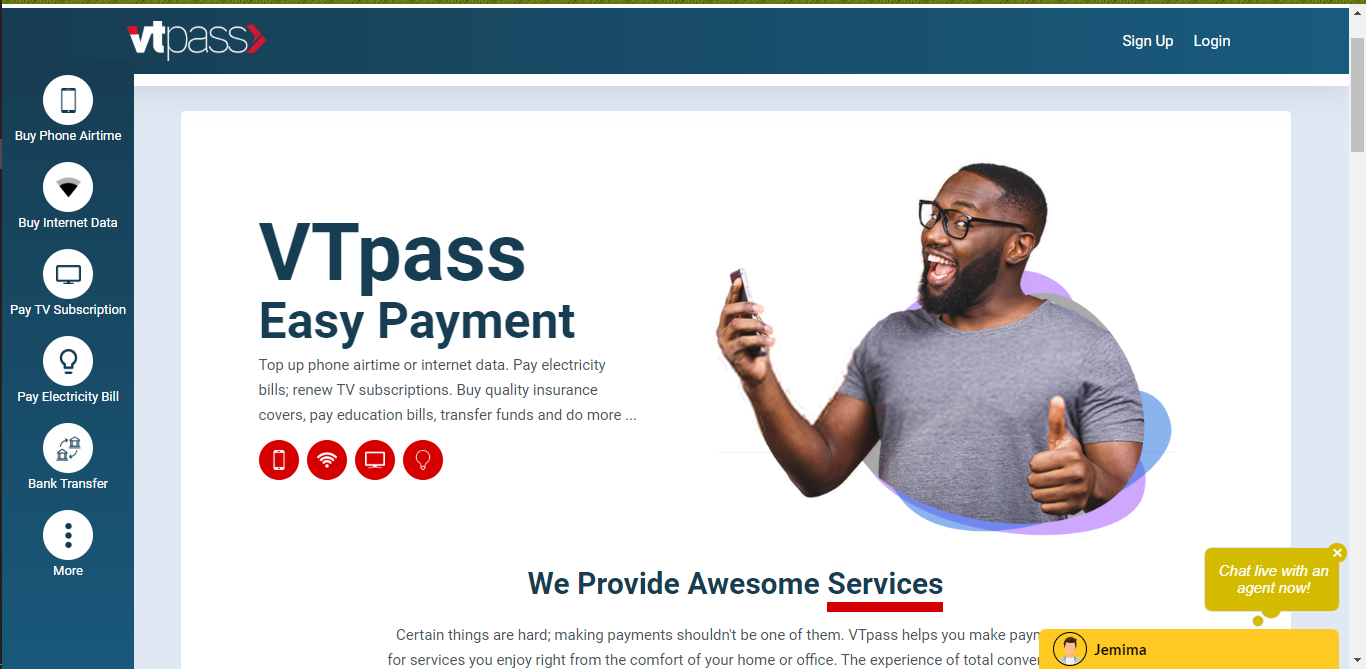

VTpass, driving e-payments in Nigeria.

Online bills payments are not reducing anytime soon. Instead, a lot more bill payers would make the switch from cash transactions in the future. You too can transit to paying bills online today.

Start by logging on to vtpass.com to pay bills in minutes. VTpass is Nigeria’s leading online payment platform that allows you to pay for the daily services you enjoy. You can top-up airtime or data, subscribe your GOtv, DStv, or Startimes, pay electricity bills, buy insurance, and do more.

Payments on VTpass are fast and easy and you get value for your money within minutes of transfers. Visit vtpass.com to get started or simply download the VTpass mobile app.