Once upon a time in bustling Lagos, Nigeria, there lived a young entrepreneur named Kemi. She ran a quaint cafe called “Heart’s Haven,” known for its delicious pastries and cozy ambiance.

Despite her culinary talents, Kemi struggled to attract customers beyond her loyal regulars. How did Smsclone solve this issue through BulkSMS?

How SMSClone Helped

As Valentine’s Day approached, Kemi grew determined to spread love and joy beyond her cafe’s walls.

Kemi discovered SMSclone for BulkSMS, using it to promote Valentine’s Day specials. With a click, she sent heartfelt invites to customers, instantly reaching them.

The Response

The response was overwhelming. Couples, friends, and families flooded into Heart’s Haven, drawn by the allure of love and the promise of delicious treats. Kemi’s cafe buzzed with laughter and conversation as customers savored every bite and shared their experiences on social media.

A Love Dilemma:

Meanwhile, across town, a young man named Tunde found himself in a dilemma. He had forgotten to buy a Valentine’s Day gift for his girlfriend, Lola, and time was running out. Desperate to make amends, Tunde turned to SMSclone for help.

Tunde, trembling, poured his heart into a message for Lola via SMSClone, hoping it would reach her in time for Valentine’s.

Meanwhile, to Tunde’s relief, Lola’s phone chimed with a notification just as she was about to leave for work. With tears of joy in her eyes, she read Tunde’s message and felt her heart swell with love. Moved by his sincerity, she forgave him instantly and made plans to meet him for a romantic dinner that evening.

How SMSClone Helped

As Valentine’s Day drew to a close, Kemi and Tunde reflected on the power of SMSclone to connect hearts and spread love. Whether it was through sharing special moments at Heart’s Haven or expressing heartfelt sentiments to loved ones, SMSclone had made this Valentine’s Day unforgettable for everyone involved.

From that day forward, Kemi continued to use SMSclone to communicate with her customers, while Tunde and Lola cherished every message they shared, knowing that love was always just a text away.

And so, the story of love in every message lived on, thanks to SMSclone – the magic wand that turned ordinary moments into extraordinary memories.

Sending BulkSMS is proven to generate massive results and unlike other Bulksms providers where it is very expensive, SMSClone offers affordable BulkSms Services.

How SMSClone Works

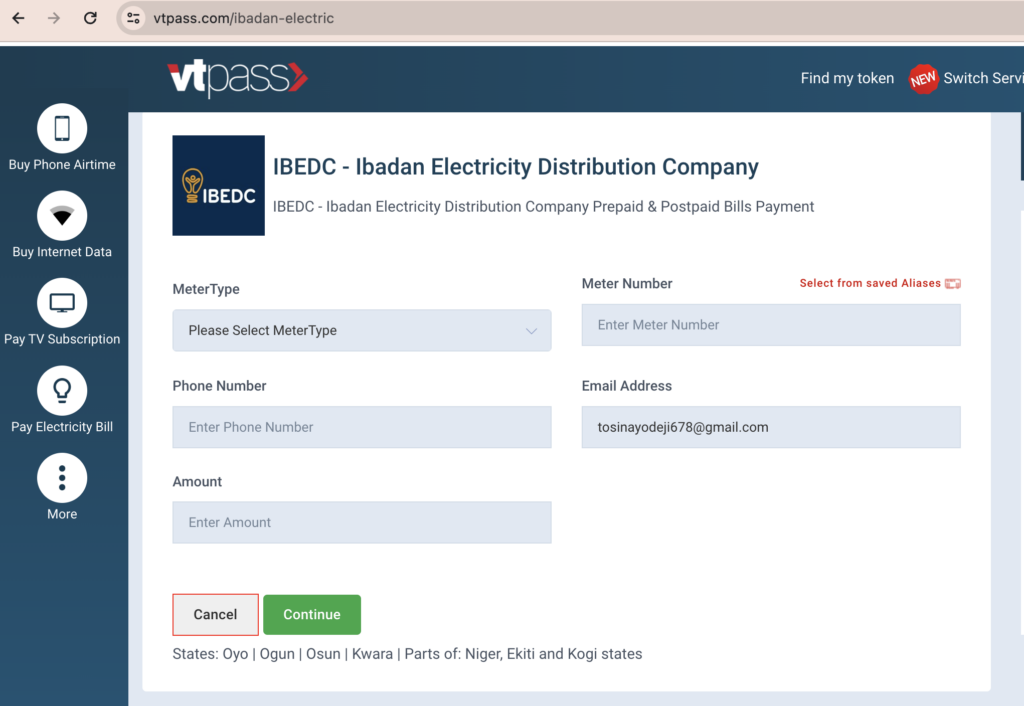

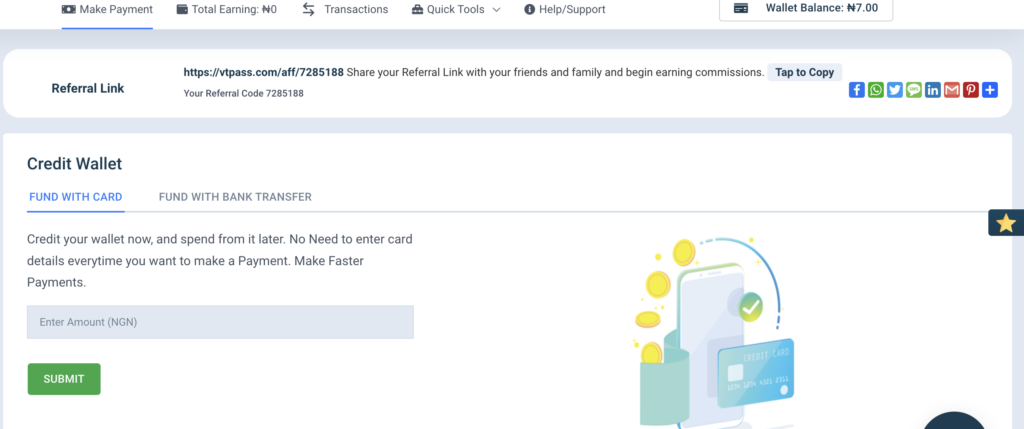

Go to smsclone.com and navigate to “Register Now”.

Register as a new Member and once you are done, you can buy units, compose SMS and send bulk messages to your lists.