If you’re a football enthusiast, then you will have no doubt been caught up in what is definitely the biggest move of the season as Messi transfers to PSG. Arguably, it is even the biggest move of this generation. Every club secretly wishes they were PSG right now. Imagine it. Having Lionel Messi play for your club, run at defences, play defence-splitting passes, ETC.

The news of Messi’s move is one that has rippled across the footballing world. Certainly, PSG this season will be a force no team will want to go up against, considering the fact that they were already a fearsome team before the 6-time Ballon d’or winner joined them.

There are those who believe that he would flop at PSG. In the same vein, others think that the PSG team would lose balance because they have too many attack-minded players. On the other hand, others say nothing can stand in the way of a football god.

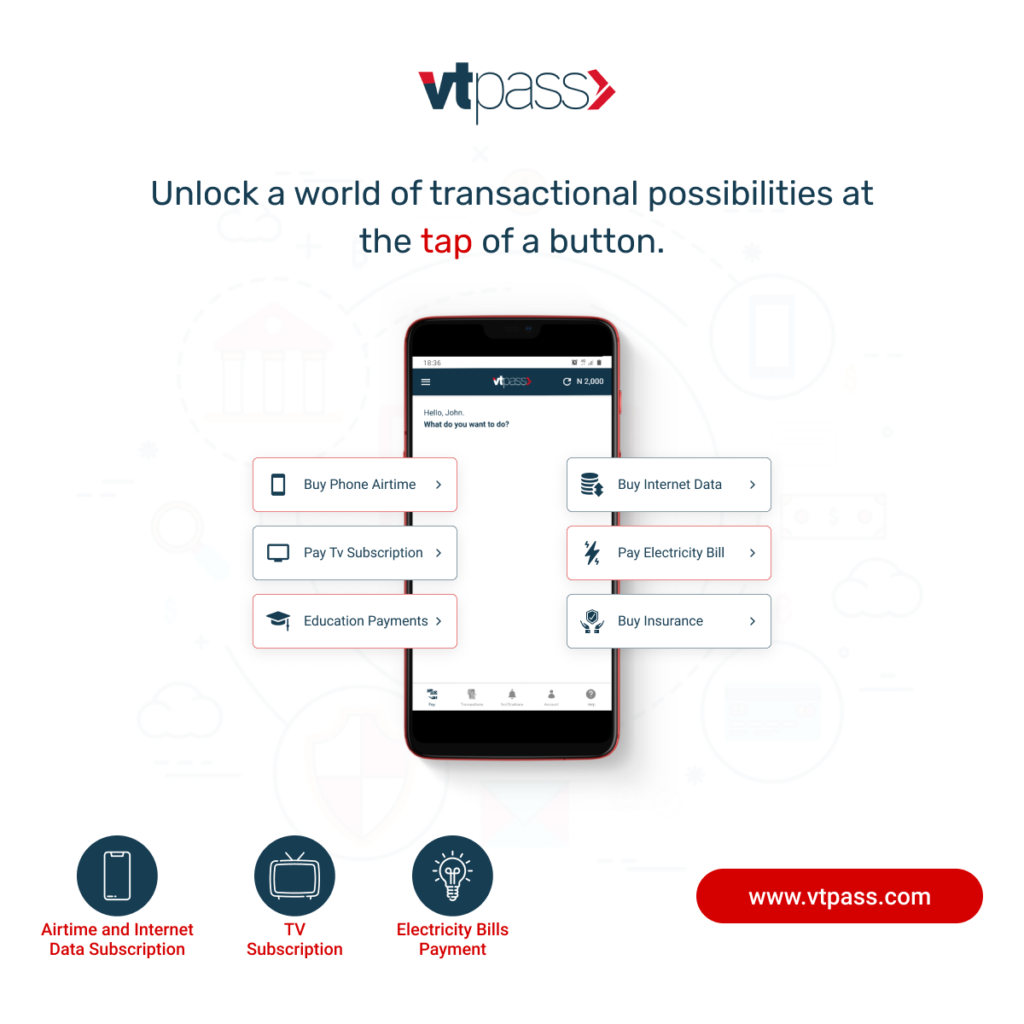

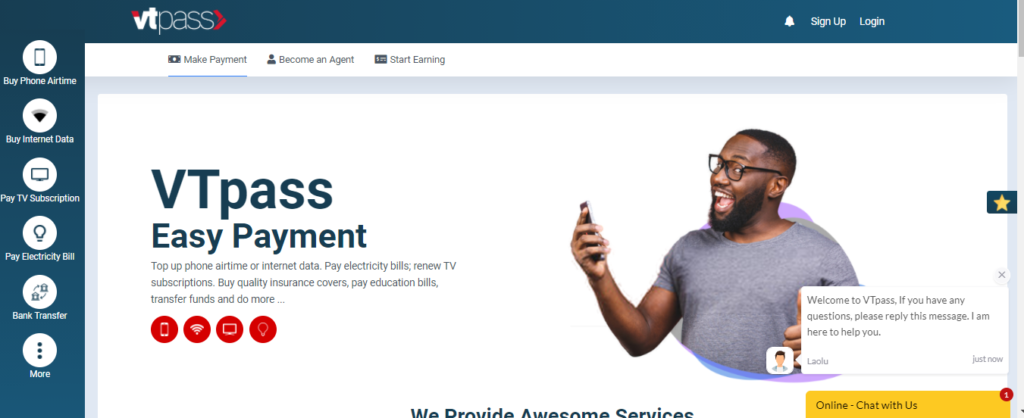

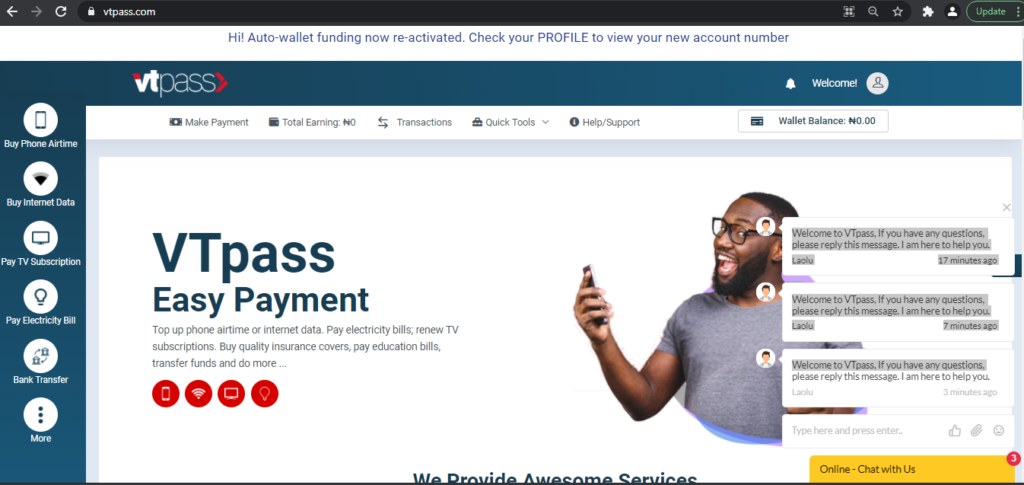

Whichever side you stand on, one thing is for certain. We all cannot wait to see Messi hit the field in PSG strips as the jury is out, and this is where VTpass comes in. To stream football matches online, you definitely need data. To watch via DSTV, GOTV or Startimes, you need an active tv subscription. In addition, you need to pay your electricity bills.

VTpass is an online bills payment platform where you can easily make payment for services like Phone Airtime Recharge, Data bundles, Cable TV subscriptions, Electricity bills, Insurance, Education and many more.

As at now, Messi is officially a PSG player. However, due to the fact that he has not had a preseason, he will likely be needing 2-3 weeks to get back into shape. We most probably will see him in September.

In conclusion, one thing is for sure. All eyes will be on PSG this season.