Data is life, or so you have heard from the famous Airtel television adverts. I often wonder how people cope without internet access due to the lack of data plan or not being able to manage your mobile data. The internet has become an integral part of our lives. As it provides us with access to information that was previously inaccessible. It’s also a powerful tool for connecting with people, for entertainment and for sharing ideas. Without internet access, many feel like they are missing out on so much.

And they are, they are missing out on so much. The Super Bowl was yesterday. Champions League continues this week, China accused the U.S. of flying a balloon over its (China) airspace. A lot of events have happened and are happening around the world that one should be aware of.

This blogpost intend to emphasise the importance of having mobile data on your smartphone at all times. These days, mobile data is money. If you don’t optimise your phone to handle it intelligently, you’re throwing dollars down the drain.

So, here are some insightful ways that can help you manage your mobile data:

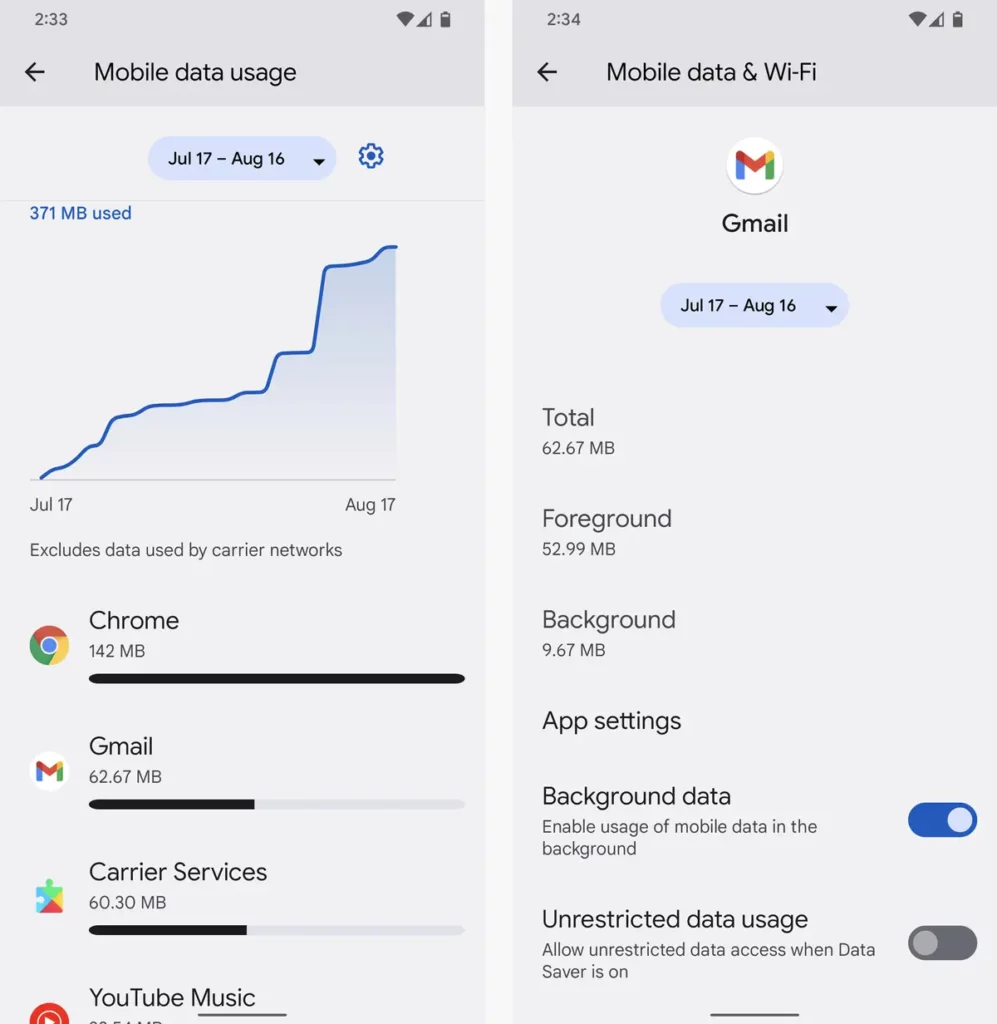

Understand your data usage: To solve a problem, you need to understand the origin of that problem. What happens here is totally dependent on the model and type of phone you currently use. Basically, whatever model of Android phone you use, you can check your data usage from the settings. When you click on settings, find mobile data usage or app data usage. When you click on the icon, you will get a detailed overview of what actions, applications have been consuming your mobile data.

In addition, you will see the rate of increase over the past 30 days. In most cases, apps that consume a large amount of data are apps that involve streaming audio and videos. Social media applications fall into this category. Make a mental note of these apps. You will know what to do with them soon. Look closely at the graph. It gives you a breakdown of the data usage of all applications installed on your smartphone. This includes those that run in the background without you needing to open the app.

Remove all auto-play and ‘auto-download’:

This is a notorious culprit in the data hoovering business. To curb this, open all your social media platforms, locate their settings, and turn off the ‘auto-play’ and ‘auto-download’ menus. Videos are among the most voracious consumers of data, and social media sites play them without your permission. But guess what? It doesn’t take much effort to change that.In the Facebook Android app, if you open the main menu, tap “Settings & Privacy,” then tap “Settings” followed by “Media,” you’ll find a series of controls that’ll reduce the size of images and videos and keep videos from playing on their own. On Twitter, you’ll find similar options in the “Data Usage” section of the app’s settings.Most social apps have similar settings, even if they require a bit of digging.

Compress your mobile web experience:

Next up is an easy fix: making your browser less of a data hog. It can save a significant amount of data — as much as 60%, according to Google’s estimates — and actually make your browsing noticeably faster as a result. (Note, however, that it doesn’t work with Chrome’s Incognito Mode). To try it out, go into Chrome’s settings and look for the line labeled “Lite Mode.” Tap it, then make sure the toggle there is activated.If you want even more data-saving tools, try Opera Mini. The browser offers its own form of remote page compression and provides a variety of settings to control how much optimisation occurs.

Optimise your music apps: You use Spotify or Youtube music? Turn down the audio quality to low. This will assist you manage your mobile data better. Make sure your music app consumes as little data as possible. Try setting it to “Low” and then see if the more data-friendly audio quality is good enough for your ears.While you’re in the settings, take a moment to confirm that the “Limit mobile data usage” and “Don’t play music videos” options are activated. Be sure to look through the settings of any such apps on your phone to make certain they’re configured in the most data-efficient manner possible.

Try the light versions of apps and websites:

A growing number of services now offer scaled-down versions of apps — apps designed explicitly to use less data while still delivering reasonably enjoyable experiences. Even if you aren’t overly worried about your mobile data usage, you might find some of them to be preferable to the regular alternatives.Google has an entire suite of “Go”-branded apps for this very purpose, and as of this writing, four of them are broadly available: Google Go, Google Maps Go, Navigation for Google Maps Go, and Gallery Go.

(The others — including Gmail Go, Google Assistant Go, and YouTube Go — are currently available only for Android Go devices.) Facebook also offers light versions of its main Facebook app and Facebook Messenger app. Instagram has launched Instagram Lite. These apps are specifically designed to take up less storage space and data than their full versions. This makes them more accessible to people with limited phone storage or data plans. This will help you manage your mobile data.

Put the Play Store on notice:

App updates are a breeze! They’re also, however, often large — and if you aren’t careful, they can use a lot of your mobile data allotment. Make sure that isn’t happening by opening up the Play Store on your phone, tapping your profile in the upper-right corner, then selecting “Settings” followed by “Network preferences”. There, you can ensure that the “Auto-update apps” option is set to “Over Wi-Fi only” and also that “Auto-play videos” is set to “Over Wi-Fi only.” If you really want to go all out, you can also change “App download preference” to either “Over Wi-Fi only” or “Ask me every time” and then avoid downloading any apps on mobile data unless it’s absolutely necessary.

Download media in advance: The most effective way to cut back on mobile data streaming is to avoid it — and many multimedia apps make that easy to do. The trick is simply to download the content you want in advance, while you’re connected to Wi-Fi. So it’ll be locally stored and available whenever you’re relying on mobile data. And don’t forget that if you subscribe to YouTube Premium or YouTube Music Premium, you also have the ability to download videos from YouTube for on-the-go viewing (and that applies on your Chromebook, too, if you’re crafty).

Look in the “Background & downloads” section of the YouTube app’s settings to adjust your offline watching settings. Then tap the three-line menu icon next to any video on the YouTube home screen to find the download option (or open the video and then look for the Download button directly beneath its title). Spotify and other audio streaming services also offer similar options.

Optimise Account Sync Settings:

Your account sync settings are set to auto-sync by default. Keep auto-sync disabled for data-hungry apps like Facebook and Google+, which use sync services to sync files like photos and videos. Google constantly sync’s your data when a change is made. Most of these sync services might not be required. This background sync service affects both your data consumption and battery life.To adjust your sync setting, go to Settings>>Accounts. There you can fine-tune sync settings for different apps. To optimise Google sync, tap on Google, and turn off the options you don’t require.

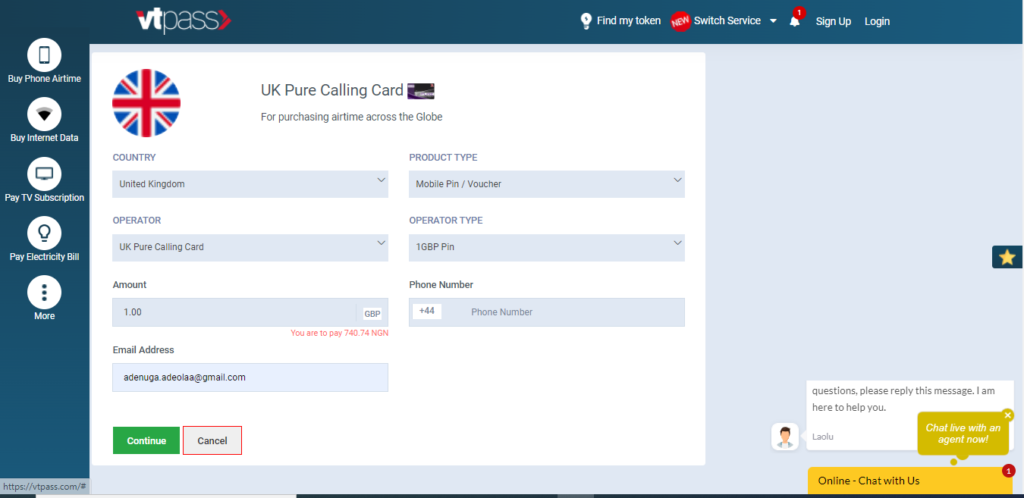

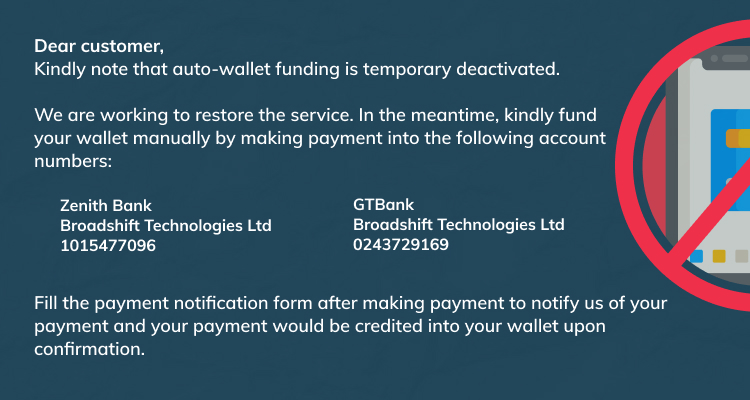

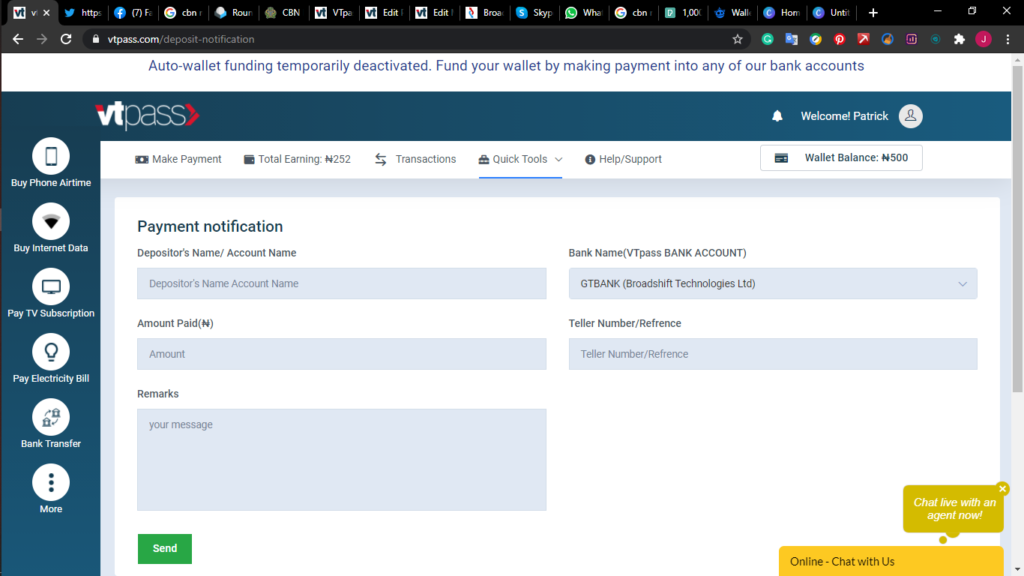

If the steps are followed, it is believed that you will be able to manage your mobile data better. Meanwhile, bills payment with vtpass.com is superfast, easy and very convenient. In addition, you get 24/7 access to our support team to help you through any glitch you might have. Why don’t you try us today?