We have some exciting news to share that will make managing your transactions a breeze. We are delighted to announce a major change to our transactions view page. This change is aimed at enhancing your overall experience.

At VTpass, we understand the importance of staying ahead of the curve and continuously improving our platform to meet your evolving needs. With this in mind, we have meticulously crafted a revamped Transactions View page.

With this update, we have set out to achieve two key objectives: first, to enhance your understanding of the status of each transaction initiated, and second, to provide you with powerful features that make navigating your transactions effortless. We’re confident that this revamp will empower you to take control of your transactions like never before.

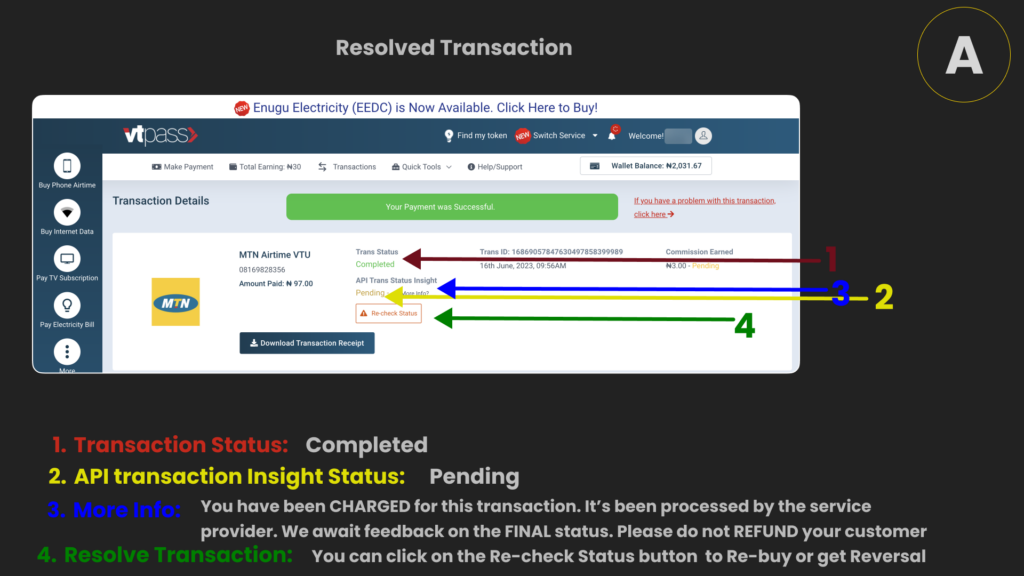

PERUSE TO UNDERSTAND EACH STAGE OF TRANSACTION PROCESS.

As of this point, the API TRANS STATUS INSIGHT indicates that this transaction is pending. This means that you have been charged for this transaction, but the value is yet to be delivered as the transaction is processed by the service provider. You are advised not to refund your customer. In this case, feedback is expected to arrive within minutes of initiating the transaction.

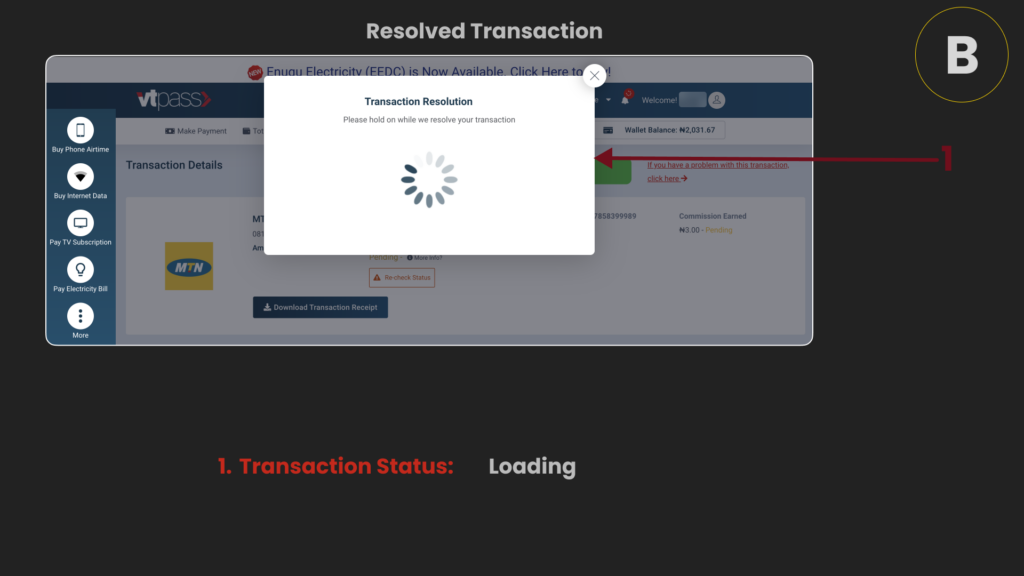

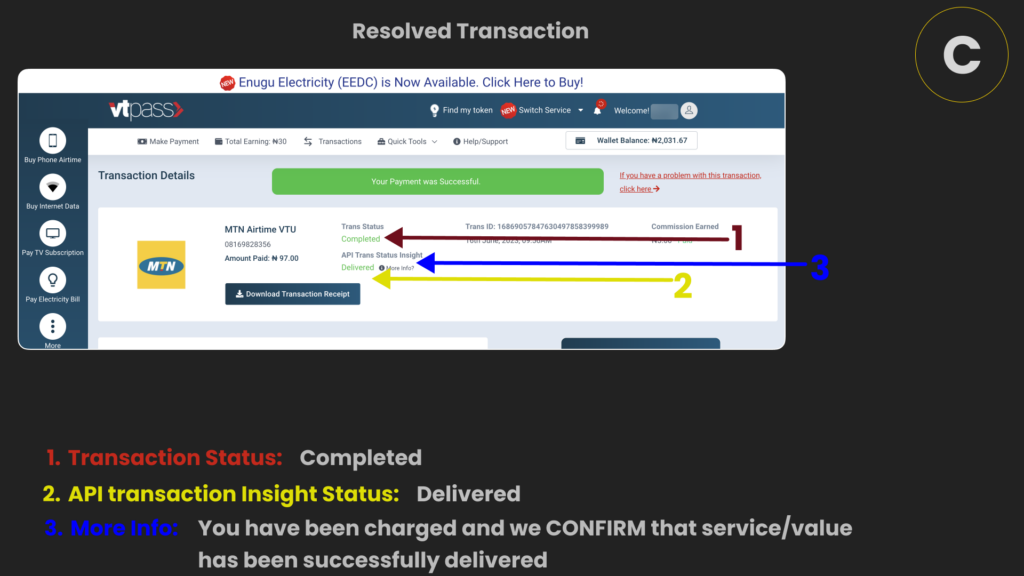

Within minutes of initiating this transaction, you should click the “Re-check Status” button to get further insight into this transaction. This will open up a “Transaction Resolution” screen as shown in Image B below.

It will take a few minutes for this page to load successfully, and the results will be either of the following:

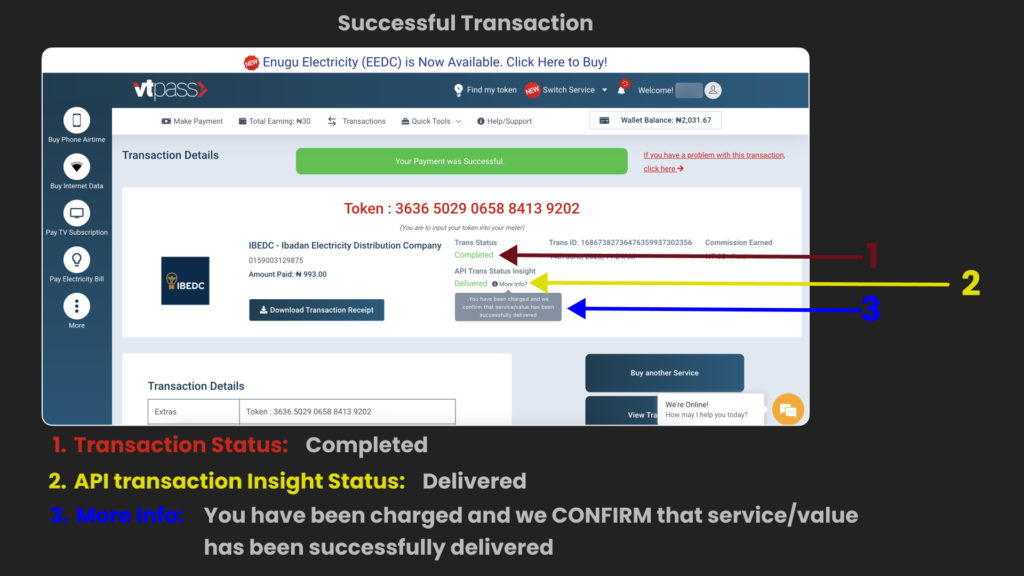

SUCCESSFUL TRANSACTION

This will confirm to you that the transaction was successful, and value has been delivered to the customer. A successful transaction means that the customer has received value for the product or service they paid for, and that their payment was processed without any issues.

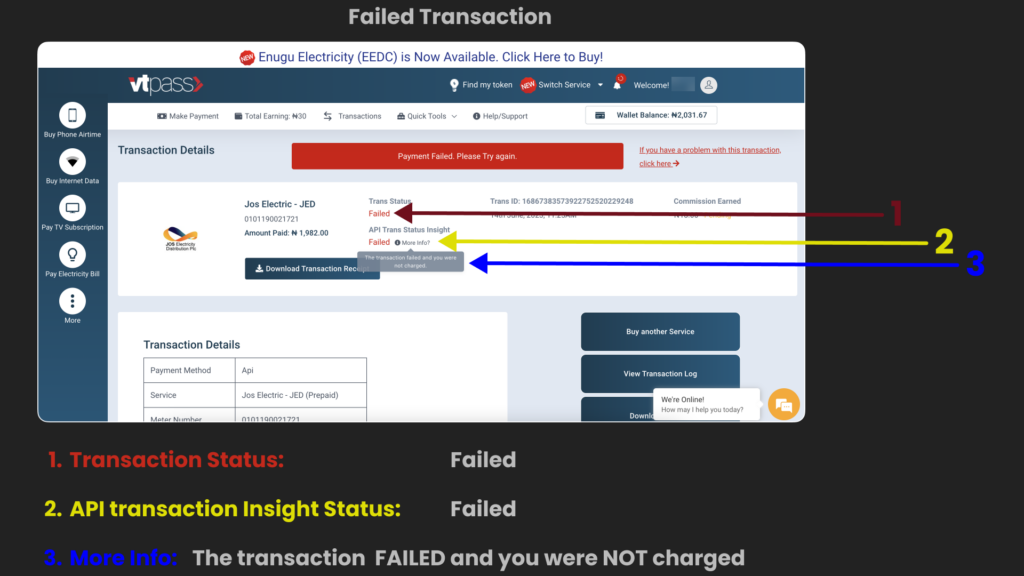

FAILED TRANSACTION

In case the window transits into this page, it simply means that the transaction failed, and could not be completed. In the event of this, we can assure you that you won’t be charged for this transaction. The window transition indicates that the transaction was unsuccessful and therefore it did not go through to the payment processor. As such, no charges have been made to your account and you will not be billed for the attempted transaction.

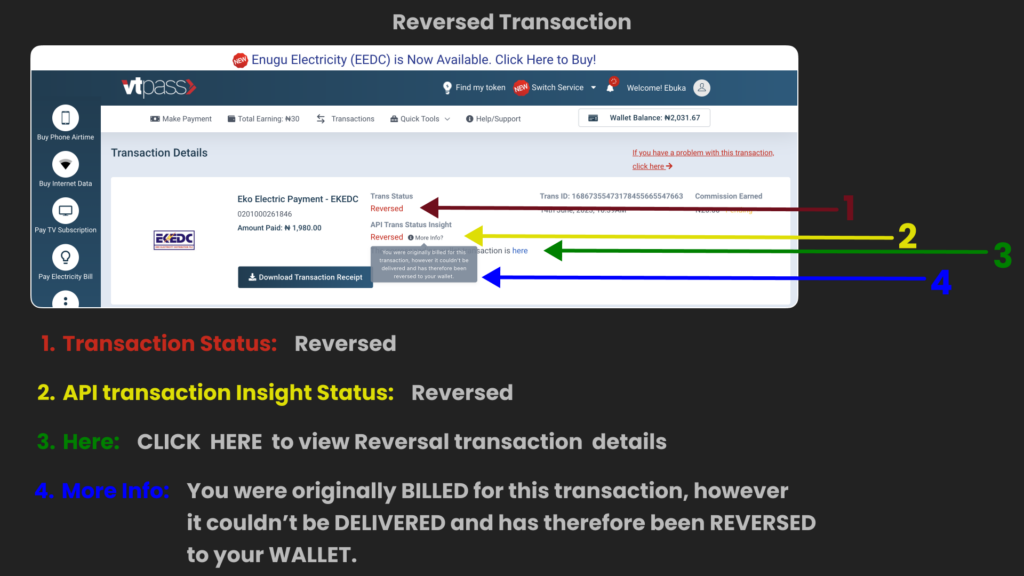

In this view, it means that the transaction failed, and couldn’t be delivered. The difference is that your wallet may be debited. Per adventure, if your wallet was debited in the process, it will be reversed automatically.

It is noteworthy that in the previous scenario where the transaction returned as FAILED, your wallet wouldn’t be debited. But in this case, your wallet, although previously been debited, would be refunded and the charges would be charged.

Stay tuned as we roll out this exciting updates in the coming days. In the meantime, don’t hesitate to contact our dedicated support team if you have questions or need assistance. We value your feedback, and we’re eager to hear your thoughts on the revamped Transactions View page.

Thank you for being part of our journey as we enhance our platform to serve you better. Here’s to smoother transactions!

At vtpass.com, we make for quick and convenient means of paying all pending bills. Just by logging in to vtpass.com, you can pay for your phone airtime- Etisalat, Airtel, MTN, GLO; your TV subscription, electricity bills, data subscription and so on.