In today’s fast-paced world, managing your utility bills can be a daunting task. Late bill payment can lead to disconnections, extra charges, and unnecessary stress. Fortunately, VTpass is here to simplify your life by providing a seamless platform for paying your utility bills. In this comprehensive guide, we will share five valuable tips to ensure that your utility bill payment experience with VTpass is smooth, stress-free, and efficient.

Tip 1: Setting Up Bill Payment Reminders

Basically, one of the most significant advantages of using VTpass for your utility bill payments is the option to set up payment reminders. Obviously, life can get busy, and it’s easy to forget payment due dates. Surely, by utilising this feature, you can receive timely notifications, ensuring that you never miss a payment deadline again. Here’s how to do it:

- Log in to your VTpass account.

- Navigate to the “Payment Reminders” section.

- Enter the details of your bills and their respective due dates.

- VTpass will send you reminders well in advance, giving you ample time to make payments.

Thus, this simple yet effective feature can save you from late fees, reconnection charges, and the inconvenience of service interruptions.

Tip 2: Explore Multiple Payment Options

In essence, VTpass understands that everyone has their preferred payment method. That’s why we offer a wide range of payment options to cater to your needs. Whether you prefer mobile money, card payment, or funding your VTpass Wallet, we’ve got you covered. Here’s an overview of the available payment options:

- Card Payment: Pay your bills securely using your debit or credit card.

- Wallet Funding: Fund your VTpass Wallet for quick and easy bill payments.

- Mobile Money: Conveniently pay your bills using popular mobile money services.

- Bank Transfer: Transfer funds directly from your bank account to settle your bills.

Essentially, having multiple payment options ensures that you can choose the one that suits you best, making the bill payment process more convenient than ever.

Tip 3: Bill Payment History at Your Fingertips

Transparency and accessibility are essential when it comes to managing your finances. VTpass provides you with a user-friendly interface that allows you to access your bill payment history with ease. Therefore, this feature is incredibly valuable for several reasons:

- Transaction Verification: You can verify that your payments were successfully processed, giving you peace of mind.

- Expense Tracking: Keep track of your monthly expenses by reviewing your payment history.

- Reference for Disputes: In the rare event of a billing discrepancy, your payment history serves as a reference point for dispute resolution.

To access your bill payment history, log in to your VTpass account and navigate to the “Transaction History” section. Here, you’ll find a detailed record of your past payments, including payment dates and confirmation receipts.

Tip 4: Exceptional Customer Support

At VTpass, we prioritise customer satisfaction and are committed to providing top-notch customer support. Due to this, our dedicated support team is readily available to assist you with any payment-related queries or issues you may encounter. Whether you have questions about a specific bill, encounter a technical glitch, or need assistance with your VTpass account, we’re here to help.

Our customer support channels include email, phone, and live chat, ensuring that you can reach us through your preferred method. Feel free to get in touch whenever you need assistance, and we’ll provide prompt and efficient solutions to your inquiries.

Customer relationship

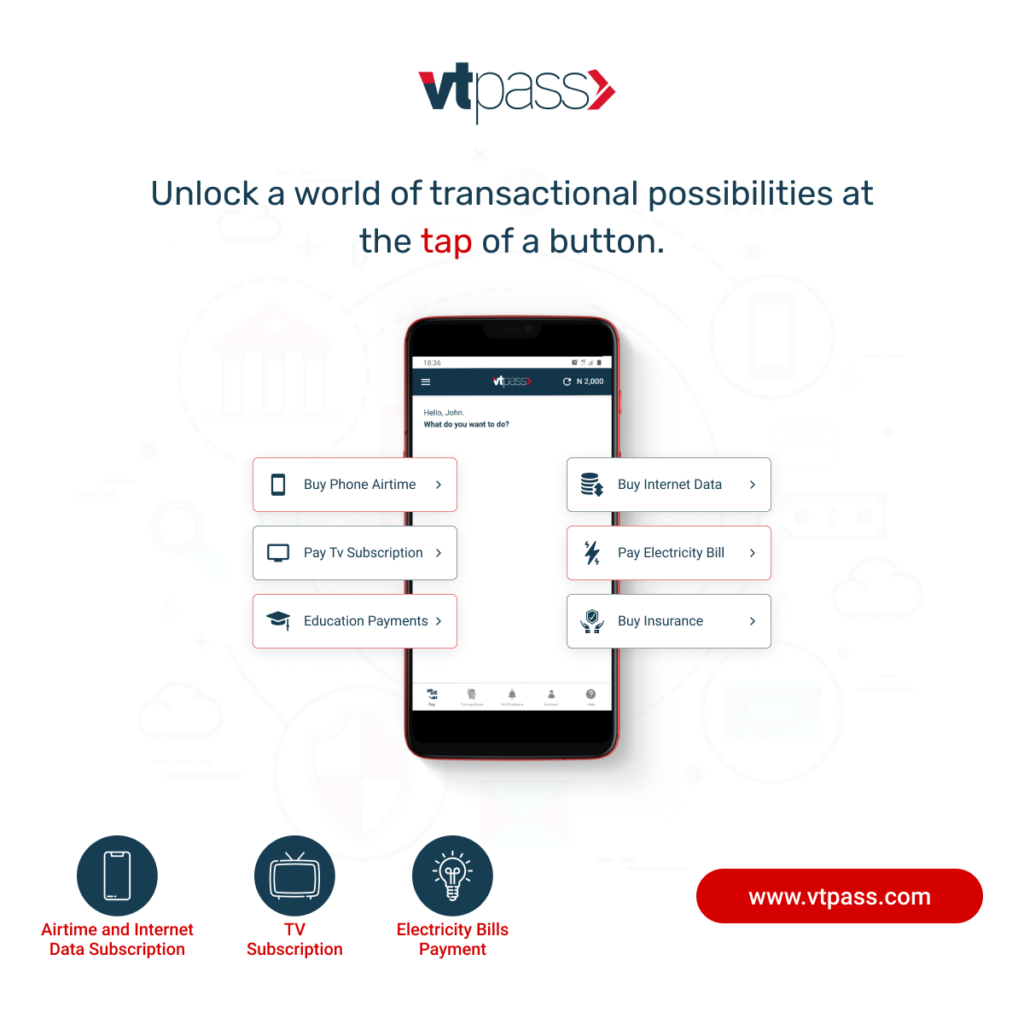

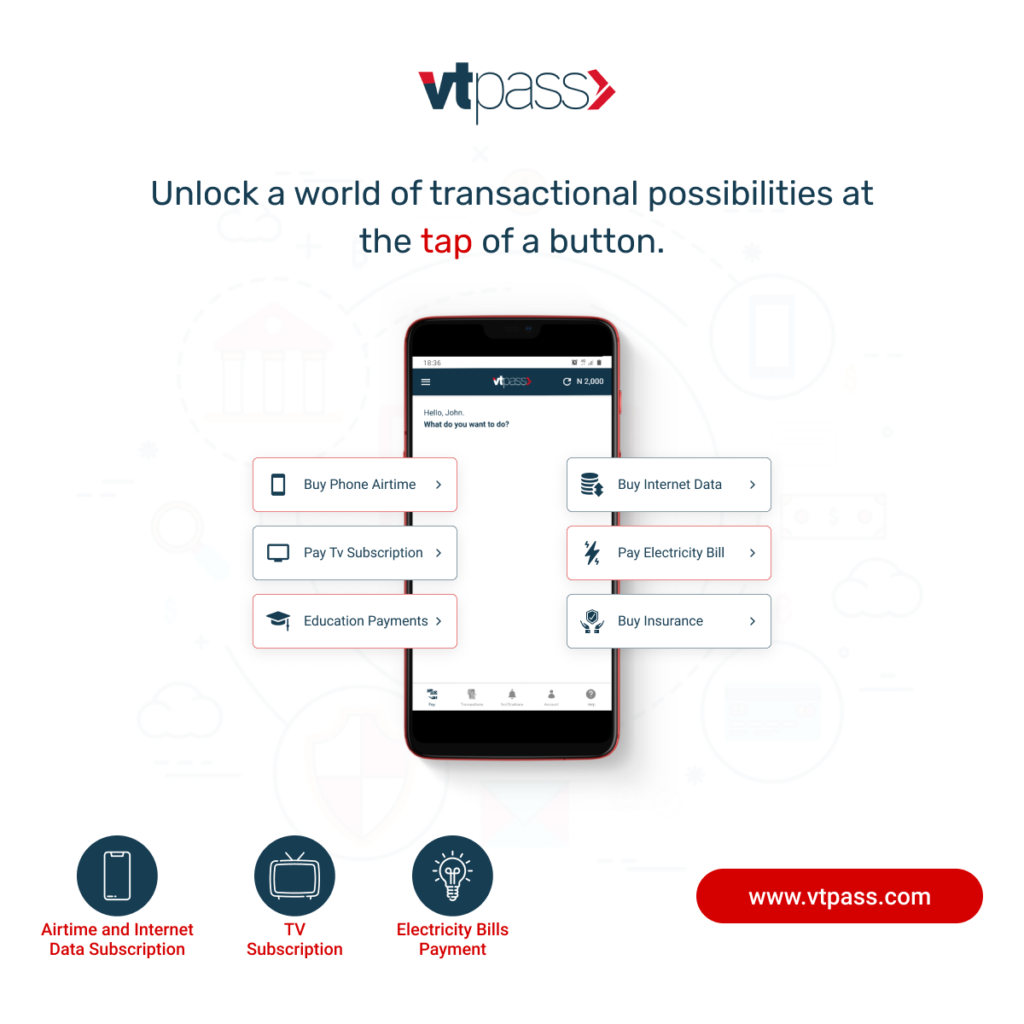

Tip 5: VTpass Mobile App for On-the-Go Payments

Significantly, in today’s mobile-driven world, convenience is key. Fortunately, that’s why VTpass offers a user-friendly mobile app that allows you to make bill payments on the go. Whether you’re stuck in traffic, waiting for a meeting, or simply prefer the flexibility of mobile payments, our app has you covered.

Key features of the VTpass mobile app include:

- Easy Bill Payments: Pay your bills conveniently using your smartphone.

- Payment Reminders: Receive timely bill payment reminders directly on your mobile device.

- Secure Transactions: Enjoy secure and encrypted transactions for your peace of mind.

- Access to Wallet: Manage your VTpass Wallet and make payments seamlessly.

The VTpass mobile app is available for both Android and iOS devices, ensuring that you can access our services whenever and wherever you need them.

Conclusion:

In conclusion, VTpass is your trusted partner for a smooth and stress-free utility bill payment experience. Furthermore, by implementing these five tips—setting up payment reminders, exploring multiple options, accessing your bill payment history, utilising exceptional customer support, and using the VTpass mobile app—you can streamline your bill payment process and enjoy the convenience of efficient, on-time payments.

Finally, don’t let late payments or service interruptions disrupt your life. Take advantage of VTpass’s user-friendly platform and payment solutions to ensure that your utility bills are paid promptly, allowing you to focus on what truly matters.