An Application Programmable Interface (API) is a set of clearly defined methods of communication between various software components. Most tech companies build APIs for internal use and for external consumers. A typical example is your Uber application where you have Google maps for navigation, Uber and Google are two different companies however Uber is leveraging Google Maps APIs to service their customers.

An API ( Application Programming Interface ) is a collection of features that details data interaction between applications. The two important parts are the services being provided and the protocol needed to access these services. On the web, APIs are used to request or send data to any platform that supports it. Business can build their solution around Vtpass API to provide services to their customers.

What sort of architecture does Vtpass API uses?

A RESTful API is an architectural style for building APIs that follows a set of guidelines for creating HTTP services. These API’s are flexible,, and easy to maintain. A RESTful API uses a stateless protocol, meaning that the server does not store any information about the client. This makes it easier to scale and maintain, since the server does not need to keep track of any data about the client. Additionally, it follows the principles of Representational State Transfer (REST), which is an architectural style that focuses on the design of the client-server interaction. This makes the API more efficient, as the client and server can exchange data quickly and easily. Vtpass API is built using this protocol.

The VTpass API is a RESTful API that allows you to integrate bills payment services available on the VTpass platform on your application. With the VTpass API, developers can easily access payment services such as Airtime, Data, Electricity and Cable TV subscription, etc. and securely process payments. This integration allows users of your application to conveniently pay their bills without having to leave your platform.

Integrating the VTpass API

First, create an account on Vtpass Sandbox. A sandbox test is an environment that enables users run a test file or a programme code. All tests are done on the Vtpass sandbox environment. There is no malicious Because testing environments are completely separate from production environments, sandboxes are useful for testing software changes before they go live. This account will be used for all your tests. It has a default wallet balance which will be debited for transactions just like in the live environment. This would allow you to run operations in the same manner as on the live environment.

Vtpass Live Environment

After completing a successful test on Vtpass Sandbox, and it is time to create a live environment. Register on the VTpass live platform, then request API access from our support team once you have your live parameters.

Who Can Use Our API?

Anyone! Well, not really anyone, but almost anyone. As long as you have a website, you can easily integrate our JAMB e-PIN API and thereby gain access to it. When you integrate, you are able to offer the same services to your own customers directly from your website. This is great because it means you are offering your customers more value.

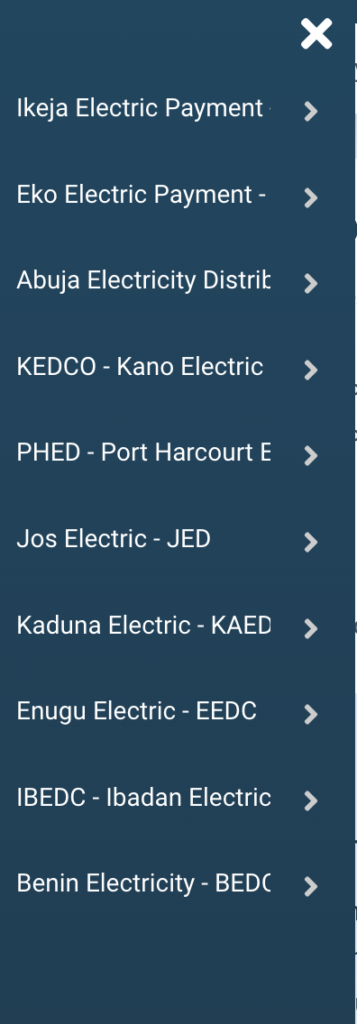

And if you want to do bigger things as an IT brain, you can integrate Vtpass.com’s API into your website or application and begin to sell any of these services to those in contact with your website or app. What this means is that you get to resell such services as 9mobile, MTN, GLO, Airtel airtime and data subscriptions, electricity bills for almost all electricity distribution companies, educational payments such as WAEC Scratch Card, cable TV subscriptions and so much more. And if you are not the technical specialist, but you have a website through which you can sell our services, you can consult your web developer or programmer who will, in turn, visit our website vtpass.com or consult our support centre and make you a retailer of our services.

And if you are not the technical specialist. But you have a website through which you can sell any of our services. You can consult your web developer or programmer. The programmer will, in turn, visit our website vtpass.com or consult our support centre. And make you a retailer of our services. But the first step is logging into vtpass.com and trying your hands on the services we sell such as phone airtime, electricity bills, data subscriptions, DStv, Startimes and GOtv subscriptions and so on.